August 2024

Introduction

As part of a study of the competition of the FactoryLab programme, we will take a look at the composition of the ecosystem of the industry of the future, in particular at its facilitating players. The aim is to map the consortia or clusters bringing together major manufacturing corporations, SMEs or start-ups supplying technology contributing to the digitisation and economic and environmental sustainability of industry. This study of the competition is based on projects completed in France and elsewhere in Western Europe, and in the USA. Initiatives of this type may also exist in other continents, particularly in highly industrialised countries. The relevance criterion for the organisations selected in the study is mainly their rationale, namely to bring together different partners from industry and research in order to transform industry so as to promote the adoption of 4.0 technology in a country or a region. Those programmes that have existed at a given time but where the contract has expired, programmes relating to a single technology and closed multilateral agreements between companies that are not intended to last over the long terms were not included.

Observations about the Industry 4.0 ecosystem

In a first general review of the Industry 4.0 programmes of the different countries, notable similarities emerge. The Industry 4.0 ecosystem includes a number of organisations, often funded publicly and promoted under national, regional or supranational guidelines. These initiatives can be distributed into several categories: industry organisations, technology resource centres, specialised clusters, competitiveness hubs, industrial consortia, research campuses and governmental initiatives. Most often, they provide a variety of services such as finding funding, advice, the preparation of roadmaps, training, standardisation, technology transfer and the execution of R&D projects. Thus, they encourage collaboration and innovation within the industrial ecosystem, speed up the adoption of the technology of Industry 4.0 and make companies more competitive. The question, then, is to find out how these programmes differ in their nature and activities from the FactoryLab programme.

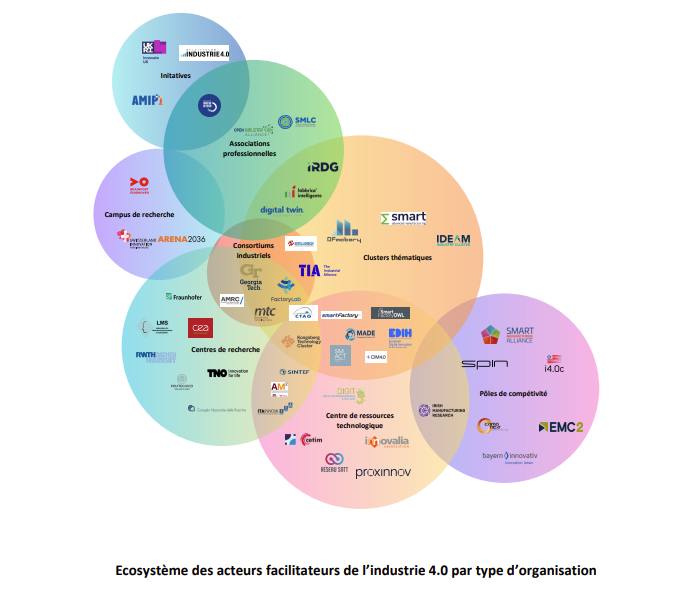

Distribution of players by type of organisation

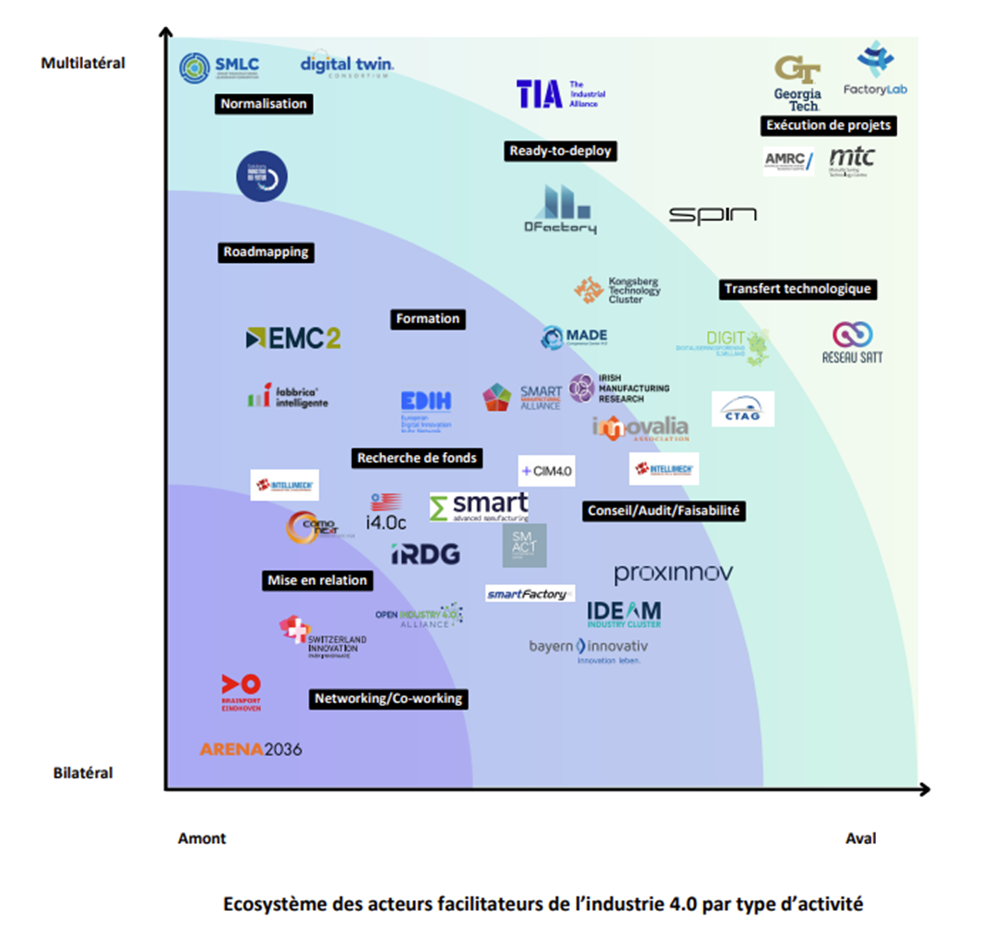

Several types of organisation play the part of facilitating Industry 4.0. Even though each of them addresses a specific industrial, scientific or regional goal, the great majority of the initiatives selected derive their impetus from national institutions (Innovate UK in the UK[1], Plattform Industrie 4.0 in Germany[2]…)[3] [4] [5], or regional bodies (such as SATTs in France[6]), or supranational institutions (such as EDIH[7]) and secure part of their funding from the public purse. Project such as Catapult Centres in the United Kingdom[8][9] and their equivalents in Norway (Catapult Norway)[10] aim to convert research into concrete manufacturing solutions for industry. While some of them are industry bodies or ministerial initiatives encompassing the entire ecosystem of the industry of the future, like the Alliance Industrie du Futur in France[11], others are groupings of companies specialised in an area of manufacturing (specialised clusters) or take the form of platforms located in a region specialised in a particular manufacturing branch, like the competitiveness hubs or competency centres that are supported by local chambers of commerce and industry as in Italy[12]. Some more original initiatives are designed to create places for open innovation, where companies, who may even compete with each other, work together in a place dedicated to innovation and testing, like Brainport in the Netherlands[13], Kilometro Rosso[14] in Italy or Arena 2036 in Germany[15]. Institutions dedicated to research and technology resources (such as the CRT mark in France[16] or CTAG in Spain[17]), act either as partners in R&D projects or as outsourced research centres for SMEs and large corporations. At the intersection between these different functions, project-oriented manufacturing consortia including industry, academia and technology providers do exist, but are far rarer (FactoryLab, MTC High Value Manufacturing[18] or Georgia Tech Consortium[19]), operate in the short term or work on a particular and restricted issue (such as TIA in France[20]). We believe it is also essential to mention the different research centres that contribute to Industry 4.0 such as CEA or Fraunhofer institutes, which are partners of a number of Digital Innovation Hubs (DIHs)[21]. These DIHs appear to be places for networking, often backed by research infrastructure that is funded partly on the national level but without the shared organisation and human resources required for the execution of projects. By classifying the different players who facilitate Industry 4.0, the ecosystem can thus be represented and studied depending on the specific form of each one, so as to bring out, as in the chart (below), porosities between the areas and roles of each player.

Eight categories emerge from this ecosystem:

Industry organisations: Groups of companies and professionals working in the same industrial sector, aiming to promote the interests of their members, disseminate information about Industry 4.0, offer specialised training and coordinate action to promote technologies and/or players. They facilitate knowledge exchange, represent collective interests and support the upskilling of the players in their sector.

Technology resource centres: Services relating to technical support, technology transfer, and support for innovation to manufacturing companies. These organisations offer technical and technological support, at the same time promoting innovation and the improvement of industrial processes.

Centres for applied research: These specialised centres focus on applied research that is oriented towards solutions to take up specific industrial and technological challenges. They are generally affiliated with universities or large corporations, and their goal is to liaise between theoretical research and its concrete applications. They offer infrastructure and expertise for research and development and support for the development and assessment of technologies, and facilitate collaboration and technology transfer. They also contribute to the economic and technological competitiveness of the sector.

Specialised clusters: Groupings of companies, research centres and academic institutions working on specific technological or manufacturing fields, which are aimed at boosting collaboration, innovation and technological development within a particular sector.

Competitiveness hubs: Groupings of companies, research laboratories and educational institutions within a given region, which aim to develop innovative collaborative projects, reinforce synergy between local players and improve regional competitiveness.

Industrial consortia: Temporary programmes (lasting months or years) that bring together companies and organisations and aim to carry out common research and development projects. Their aim is to pool resources and skills to develop innovative technological solutions and share the risks and benefits of projects.

Research campuses: Physical areas devoted to research and innovation, with universities or large corporations, offering R&D infrastructure in an open innovation approach. These are places that promote closer collaboration between researchers, students and companies, in order to transfer technology and develop new solutions.

Governmental initiatives for Industry 4.0: Programmes and action put in place by governments to support the digital transformation of industry, including financing, and regulations that are favourable to development and support infrastructure. Their aim is to encourage the adoption of the technologies of Industry 4.0, enhance national or regional competitiveness and support industrial innovation.

Distribution of players by their activities

The different players facilitating Industry 4.0 can also be divided by the nature of their activities. These organisations, which are grouped into several service categories, are primarily positioned according to their added value in an R&D project. Indeed, what needs to be determined is whether they take charge of the preliminary conditions of the project, by creating a place, looking for funds, training or feasibility studies. In that case, they can also take charge of the concrete implementation of a solution, in the form of technology transfer (like SATTs[22] or IRTs[23]), or the pooling of technologies (ready-to-deploy) or also the direct execution of R&D projects. As for their range of action, the organisation may work alongside several other players at the same time as the standardising entity, like the Alliance Industrie du Futur, which imposes technological roadmaps on the national level[24], or in a particular area (e.g. Digital Twin Consortium[25]).

Some organisations can also hold contracts for the shared programmes of all the participating companies in the form of a consortium (these include FactoryLab, MTC High Value Manufacturing[26] or TIA), while others offer bilateral work to each partner, like CEA. Among these facilitators, some take charge of services upstream from the materialisation of the project, such as Alliance Industrie du futur or competency centres, whilst others participate downstream, in the concrete performance of the R&D work of their partners, such as FactoryLab or Georgia Tech. By combining these two lines of analysis, the facilitators of Industry 4.0 can thus be classified and studied based on their specific role and the impact of their contributions, thereby offering a structured and clear overview of the support dynamics in the field.

Ten categories thus emerge from this ecosystem:

Search for funding: Identification and securing of the funding required for the development and execution of R&D projects. That can include public grants/subsidies, private investment and financial partnerships. It helps ensure that projects have adequate financial resources to succeed and maximise their impact.

Advice/Audit/Feasibility: Offer of expertise services to assess the current state of R&D processes. This includes systems audits, feasibility studies and recommendations. It helps companies understand how to effectively incorporate new technologies and measure the impact on their operations.

Roadmapping: Preparation of a strategic roadmap for the implementation of R&D projects, including the planning of stages, resources, schedules and responsibilities. It can help provide a clear and organised plan to guide companies in their digital transformation.

Training: Development of programmes to train employees in new technologies and the working methods of Industry 4.0. This ensures that employees have the skills required for working efficiently with new technologies, and thus maximises the benefits of the innovations put in place.

Standardisation: Reflection, preparation and promotion of standards for manufacturing technologies and processes, in order to guarantee the fulfilment of certain requirements such as interoperability, safety and security and quality. It helps integrate technologies and ensure that the solutions deployed are consistent and reliable.

Ready-to-deploy: Supply of technological solutions that are ready to be deployed in manufacturing environments. It reduces implementation times and ensures the speedy and effective adoption of new technology.

Technology transfer: Facilitation of the transfer of new technologies developed by laboratories to manufacturing companies. It helps speed up the adoption of advanced technology by industry in order to improve competitiveness and efficiency.

Project execution: Management and performance of projects based on manufacturing technologies, covering all the stages from design to implementation and monitoring. It helps ensure that projects are completed on time, stay within a definite budget and achieve set goals, while making concrete improvements to manufacturing processes.

Networking/Co-working: Construction and coordination of places and events where industry professionals, technology providers, researchers and start-ups can meet, collaborate and share ideas. That includes the organisation of meetings, webinars/conferences, industry fairs and the development of online collaboration platforms. It aims to promote the exchange of knowledge, stimulate innovation and encourage partnerships between different players. Networking: facilitating contact and collaboration between manufacturing companies and technology providers. Ultimately, it speeds up the integration of new technology, but putting relevant players in contact with each other, and making it easier to find technological solutions adapted to the needs of the different players.

An enduring need for the industry of the future

The results of our study show that at the present time, the FactoryLab programme has no equivalent, if one sets aside temporary or bilateral agreements between companies that are not intended to last over time as a permanent platform open to a plurality of players.

In Germany, studies have been conducted to identify the composition of the different clusters.[27] On average, they are made up of 125 members; a third of these consortia have fewer than 50 members, and according to certain sources, the viability of a programme hinges on their having a minimum of 25 members. In the cluster landscape, the share of SMEs varies from 12 % to 92 %, with a national average of 55%, and they are thus made up of 12% of large corporations and 11% of academic and R&D players. 40% of their funding is public, 30% comes from membership fees, 18% from services, 6% from the supply of goods and 6% from other private funds.

Among the benefits sought by their members, the leading pay-offs are contact with other companies (86%), finding potential cooperation projects (70%), finding information about technological developments (63%), relationships with research centres (47%), image (24%) and market development (19%).

That reality can also be seen within FactoryLab, where our partners have sought to work together, discover new technological developments, set up relationships with technology providers and reputed research centres for their leading edge knowledge and skills, and anticipate or prepare for future markets. The motivations observed in Germany are therefore comparable to those that have prompted our members to join FactoryLab, which covers the essential needs of industry today.

Our competitive advantage

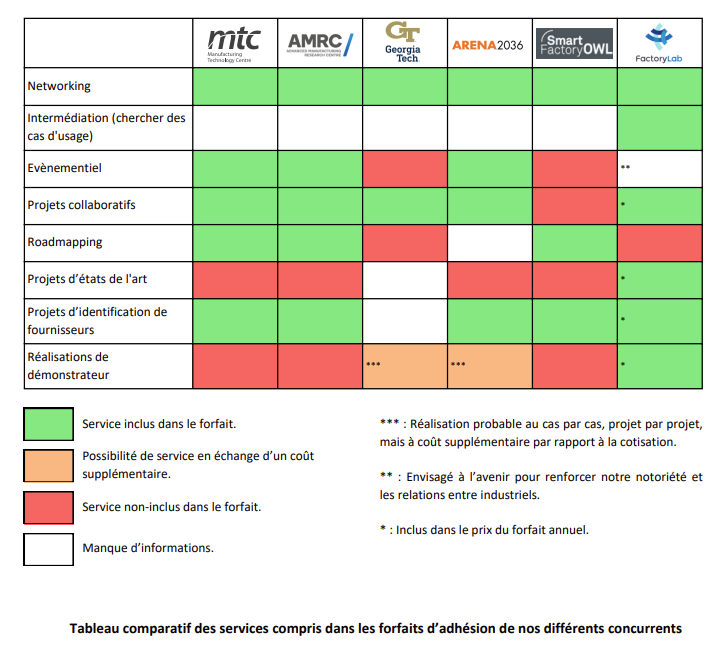

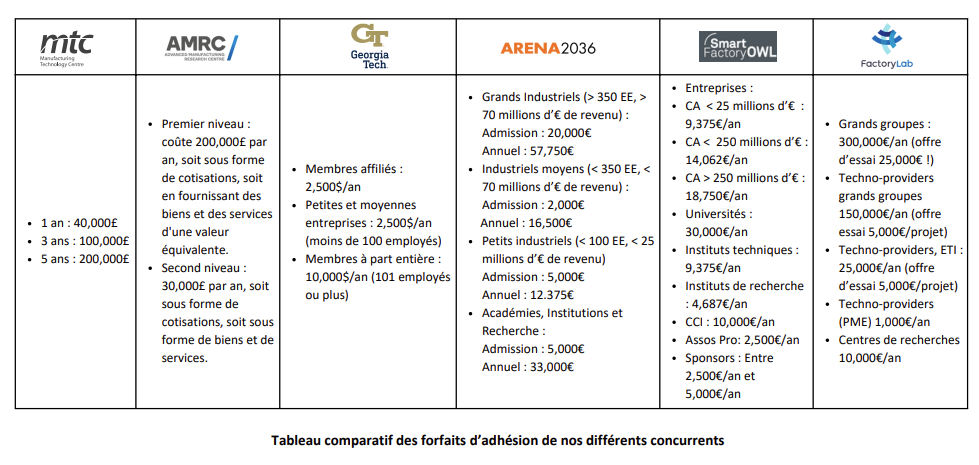

In respect of the services supplied and the cost of membership, it would be useful to assess our advantages compared to other competing programmes, either in terms of their attractiveness for industry or because their working model is similar to ours.

Regarding services, we are favourably placed in all areas. No technological roadmapping service is provided by FactoryLab, which is specialised in the downstream part of R&D projects, that is to say their execution. However, recent reflection has led to considering the provision of such services in areas with a clear scope (e.g. generative AI for manufacturing), in order to inform a possible applicative pathway (concrete projects) for the adoption and appropriation of subjects.

Having taken into account the different service offerings of our various competitors, we could say that we are advantageously placed in view of those provided by our organisation. As regards the price, even though we are close to the average of our direct competitors MTC High Value Manufacturing[28], AMRC[29] and Georgia Tech[30], we stand apart through the inclusion of certain services in the annual subscription, considered to be additional or not provided.[31] [32]

Conclusion

It can be seen that it is crucial for manufacturers to be able to meet potential technological and research partners, as that is vitally important for their efforts to innovate. Indeed, such meetings can result in the sharing and pooling of manufacturing issues, the identification of roadmaps, the performance of projects, both upstream and downstream from the projects themselves. The particularity of these groupings dedicated to innovation lies in the shared perception of the challenges by the partners, thus making the choice of members absolutely crucial. As each consortium is unique, there is no universal solution that is suitable for all, independently from differences in terms of working times and cycles, which closely depend in turn on the goals of each member. Lastly, the consortia must organise effective mediation, and demonstrate a certain ability to adapt, whether for tailored projects or specific governance.

[1] Innovate UK: https://www.ukri.org/councils/innovate-uk/

[2] Plattform Industrie 4.0: https://www.plattform-i40.de/IP/Navigation/EN/Industrie40/WhatIsIndustrie40/what-is-industrie40.html

[3] BLANCHET Max, « Industrie 4.0 Nouvelle donne industrielle, nouveau modèle économique », Outre-Terre, 2016/1 (N° 46). : https://www.cairn.info/revue-outre-terre2-2016-1-page-62.htm

[4] Saint-Petersburg Polytechnical University, “Interaction of science, education and industry in European countries. Statement of the problem, development trends” : https://www.spbstu.ru/international-cooperation/expert-center-international-cooperation/scientific-cooperation/cooperation-academic-industrial-partners/

[5] Japan Science & Technology Agency, “Panoramic View Report R&D Strategy in Major Countries (2022)” https://www.jst.go.jp/crds/pdf/2021/FR/CRDS-FY2021-FR-02.pdf

[6] Le Réseau SATT : https://www.satt.fr/le-reseau-satt/

[7] European Commission, European Digital Innovation Hubs: https://digital-strategy.ec.europa.eu/fr/activities/edihs

[8] Catapult UK, High Value Manufacturing: https://hvm.catapult.org.uk/#

[9] Ambassade de France au Royaume-Uni, « Les centres Catapult », Science & Technologie au Royaume-Uni, (N°77). 2015/12: https://www.diplomatie.gouv.fr/IMG/pdf/201512_dossiersstcatapults_cle4e6a11.pdf

[10] EKERGEN Katarina, “Norwegian Catapult develops a national infrastructure for innovation”, Nordic Testbed Network, 2021/12: https://nordictestbednetwork.se/2021/12/20/norwegian-catapult-develops-a-national-infrastructure-for-innovation/

[11] Alliance Industrie du Futur: http://www.industrie-dufutur.org/

[12] Ministero delle Imprese e del Made in Italy, “Centri di competenza ad alta specializzazione”: https://www.mimit.gov.it/index.php/it/incentivi/centri-di-competenza-ad-alta-specializzazione

[13] Brainport Industries: https://www.brainportindustries.com/en/factoryofthefuture

[14] Kilometro Rosso: https://www.kilometrorosso.com/en/

[15] Arena2036: https://arena2036.de/en/member-benefits

[16] Ministère de l’Enseignement Supérieur et de la Recherche, « Les structures de diffusion technologique » : https://www.enseignementsup-recherche.gouv.fr/fr/les-structures-de-diffusion-de-technologies-46263

[17] Centro Tecnológico de Automoción de Galicia: https://ctag.com/en/ctag/about-ctag/

[18] The Manufacturing Technology Centre: https://www.the-mtc.org/about-us

[19] The Georgia Tech Manufacturing 4.0 Consortium: https://ampf.research.gatech.edu/how-engage

[20] R. Vincent, « The Industrial Alliance, naissance d’un nouveau consortium de l’Industrie 4.0 », lindustrie4.0, 2021/10: https://lindustrie40.fr/the-industrial-alliance-naissance-dun-nouveau-consortium-de-lindustrie-4-0/

[21] CEA, Au cœur des dynamiques d’innovation technologiques régionales et nationales https://list.cea.fr/fr/page/au-coeur-des-dynamiques-dinnovation-technologiques-regionales-et-nationales/

[22] The SATT network: https://www.satt.fr/

[23] Ministère de l’Enseignement Supérieur et de la Recherche, Investissements d’avenir, « Les instituts de recherche technologique (IRT) » : https://www.enseignementsup-recherche.gouv.fr/fr/les-instituts-de-recherche-technologique-irt-46411

[24] Alliance Industrie du Futur: http://www.industrie-dufutur.org/nos-missions-2/

[25] Digital Twin Consortium: https://www.digitaltwinconsortium.org/about-us/

[26] The Manufacturing Technology Centre: https://www.the-mtc.org/about-us

[27] The German Economic Team, Cluster initiatives in Germany – common activities, organisational and financing models, 2020/05: https://www.german-economic-team.com/wp-content/uploads/2022/01/GET_BLR_PB_05_2020_EN-1.pdf

[28] Manufacturing Technology Centre: https://web.archive.org/web/20240420130855/https://the-mtc.org/membership/overview/

[29] Advanced Manufacturing Research Centre: https://www.amrc.co.uk/pages/membership

[30] Georgia Tech Consortium – Membership Agreement https://ampf.research.gatech.edu/sites/default/files/2024-03/Georgia%20Tech%20Manufacturing%204%20Consortium_MembershipAgreement_%20FY25%20Fillable.pdf

[31] The German Economic Team, Cluster initiatives in Germany – common activities, organisational and financing models, 2020/05: https://www.german-economic-team.com/wp-content/uploads/2022/01/GET_BLR_PB_05_2020_EN-1.pdf

[32] Research Campus ARENA 2036, Registered Association Bylaws (2019)

Author: Laure FAINELLA, FactoryLab Technology Monitoring Manager, CEA-List

Under the supervision of: Jean-François DUROCH, Director of the FactoryLab programme, CEA-List